[ad_1]

Since mid-January Bitcoin (BTC) has been facing mounting selling pressure from various market players. This includes asset manager Grayscale, bankrupt crypto exchange FTX, and now, the US government, which is set to auction off a substantial amount of Bitcoin seized from the infamous dark web marketplace Silk Road.

Sale Of Confiscated Silk Road Bitcoin

The US government has filed a notice to sell approximately $130 million worth of Bitcoin confiscated from Silk Road. The filing states that the United States intends to dispose of the forfeited property as directed by the United States Attorney General.

Individuals or entities, except for the defendants in the case, claiming an interest in the forfeited property must file an ancillary petition within 60 days of the initial publication of the notice.

Once all ancillary petitions have been addressed or the filing period has expired, the United States will obtain clear title to the property, enabling them to warrant good title to subsequent purchasers or transferees.

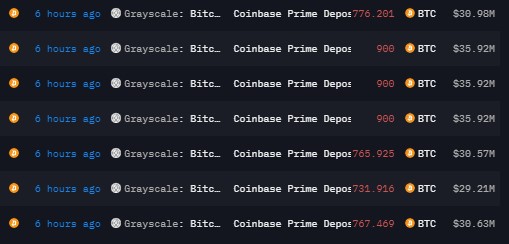

The ongoing selling pressure on BTC has resulted in a sharp 20% correction over the past 10 days. This trend is expected to continue and further amplify the selling pressure. Adding to the situation, asset manager Grayscale, while slowing down its selling activities, continues to transfer a significant amount of Bitcoin to Coinbase.

According to data from Arkham Intelligence, Grayscale recently sent an additional 10,000 BTC worth $400 million to Coinbase.

Since the approval of the Bitcoin spot exchange-traded fund (ETF), Grayscale has deposited a total of 103,134 BTC ($4.23 billion) to Coinbase Prime. Currently, Grayscale holds 510,682 BTC ($20.43 billion).

Ideal Buying Opportunities?

Adam Cochran, a prominent market expert, has provided insights into the recent price action and the expectations of Bitcoin buyers. Cochran highlights that aggregate open interest (OI) for BTC has decreased by 17% from recent highs but remains around 20% higher than the averages observed during more stable market ranges.

Cochran notes that the market has seen attempts to catch falling prices, suggesting a mix of “sophisticated” and leveraged buyers.

Cochran further observes that retail investors are driven by narratives surrounding the ETF and halving events, leading them to buy dips on leverage. However, many investors remain unconvinced about the market’s direction and are waiting for a clear entry point, according to Cochran’s analysis.

Notably, Cochran highlights that the current funding rates do not indicate a bearish sentiment, even in options trading, suggesting an expectation of a bottom formation shortly.

The market’s dynamics are influenced by emotions and probabilities, and Cochran believes that too many participants are overexposing themselves emotionally by trying to catch the bottom of the market on each dip.

This behavior has increased the likelihood that the recent price action may not mark the bottom yet. Cochran suggests that a sentiment reset, a decline in the 3-month annualized basis by around 25%, and a further decrease in open interest would provide a healthier environment for major plays in the market.

Ultimately, Cochran emphasizes the need for a reset in expectations, highlighting that a period of doom and despair is necessary for market participants to reassess their positions.

Cochran points out that a range between $35,000 and $37,000 BTC could be a suitable level for larger spot buys in the longer term. However, Cochran also notes that a potential drop to the $28,000 to $32,000 range could provide ideal conditions for confident, leveraged deployment.

Currently, BTC is trading at $39,800, up a slight 0.6% in the past 24 hours, but down over 14% in the past fourteen days.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]

Source link