[ad_1]

In a recent analysis, Stanislas Bernard, the founder of Sinz 21st.Capital, delved into the complexities surrounding Hong Kong’s consideration to approve spot Bitcoin ETFs against the backdrop of China’s escalating economic crisis. With the nation grappling with a record debt-to-GDP ratio of 288% in 2023, and witnessing one of the most severe housing market collapses in three decades, the financial instability has triggered an unprecedented capital flight towards overseas markets.

The Perfect Timing For A Spot Bitcoin ETF?

Amidst these turbulent economic times, Hong Kong’s potential approval of spot Bitcoin ETFs stands out as a pivotal development that could not only be a safe haven for Chinese investors but also significantly influence Bitcoin’s valuation, potentially catapulting it to the elusive $100,000 mark.

China’s economic woes have been intensifying, marked by a towering debt ratio and a plummeting housing sector that has investors scrambling for alternatives. “China currently faces a significant economic downturn, exacerbated by soaring debt and malinvestments in real estate. The crisis, becoming well-known in 2021 with the default of Evergrande Group, has now spread, causing a ripple effect that will likely slow down the Chinese economy for years to come,” Bernard pointed out.

This backdrop of economic instability has incited a significant shift in investor behavior, notably among Chinese investors who, faced with stringent capital controls, have sought refuge in ETFs that offer exposure to foreign markets. Yet, this avenue has been fraught with its own challenges.

“Investors are paying premiums as high as 43% on certain US-focused ETFs due to quota limitations, which speaks volumes about the desperation to find safer investment harbors,” Bernard notes. Such premiums underscore the pervasive fear and uncertainty that have gripped the Chinese market, driving investors towards seemingly any available exit from the volatility of the domestic market.

The Role Of Hong Kong

Bernard believes that not only Hong Kongers but also Chinese mainlanders will flock to Bitcoin ETFs. “They are pretty integrated. Mainland is HK’s largest trading partner. Would not be possible to approve a spot ETF and then close it to mainland. They will enforce transaction limits instead,” the expert said.

In the midst of these developments, Hong Kong’ Securities and Futures Commission (SFC) is reportedly considering the approval of spot Bitcoin ETFs already by the end of April, as reported yesterday. This move is viewed as a strategic effort to capture a portion of the capital flowing into Bitcoin, especially in the wake of the SEC’s approval of similar ETFs in the US, which saw a meteoric rise with $12 billion of net flow.

“Hong Kong is scrambling for a change. The approval of spot Bitcoin ETFs could unlock a vast reservoir of stranded Chinese capital into Bitcoin, providing a much-needed life raft for investors,” Bernard explained.

The anticipated approval of spot Bitcoin ETFs by Hong Kong authorities has been met with significant enthusiasm within the crypto community. Influential figures such as Bitcoin Munger and Stack Hodler have been vocal about the potential impact of this development on Bitcoin’s price.

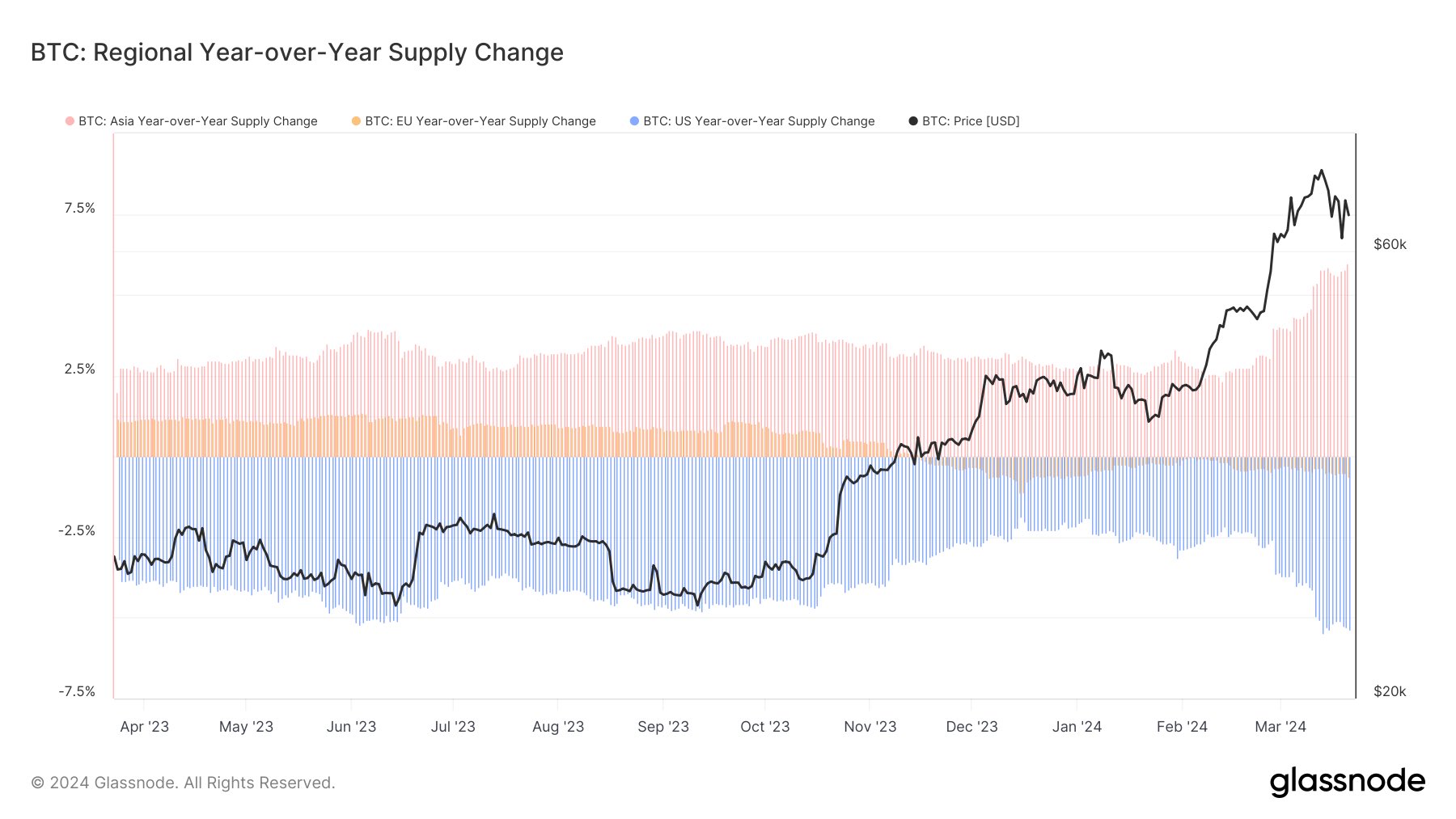

“Hong Kong ETFs approval have accelerated to next week. Most accounts on CT weren’t making a big deal about them, but they are a big deal. They are going to take us to $100k+ in due time. Tick tock!” stated popular Bitcoin analyst Bitcoin Munger (@bitcoinmunger). He refers to the regional yearly year-over-year supply change from West to East.

Stack Hodler (@stackhodler) further emphasized the urgency among Chinese investors to find secure investment avenues outside the traditional system, “Chinese investors were panic-buying a Gold fund at a 30% premium this month as they attempt to get their wealth into something outside the Chinese system. The approval of Hong Kong spot ETFs could be the turning point, offering a sanctioned avenue for wealth preservation amidst the crumbling real estate market.”

Overall, the potential approval of spot Bitcoin ETFs in Hong Kong is poised to be a landmark development, not just for the region but for the global market. By offering a secure and regulated channel for investment, it could serve as a catalyst for significant capital inflow into Bitcoin, reinforcing its status as a viable store of value.

“As we stand at the cusp of this historic development, the implications for Bitcoin and the broader cryptocurrency market could be profound. The approval of spot Bitcoin ETFs in Hong Kong could indeed be the harbinger of a new era, potentially driving Bitcoin’s value to new heights,” concluded Bernard.

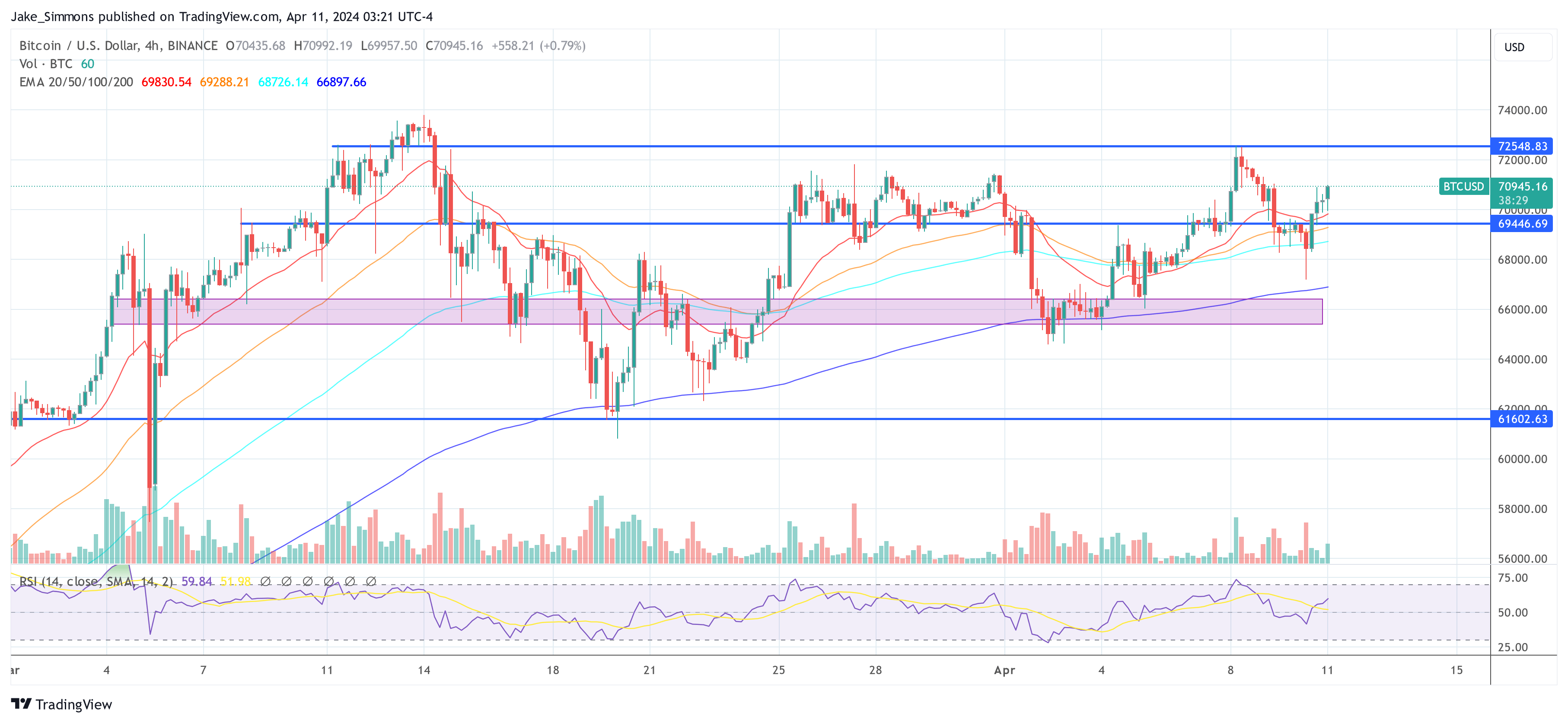

At press time, BTC traded at $70,945.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]

Source link