[ad_1]

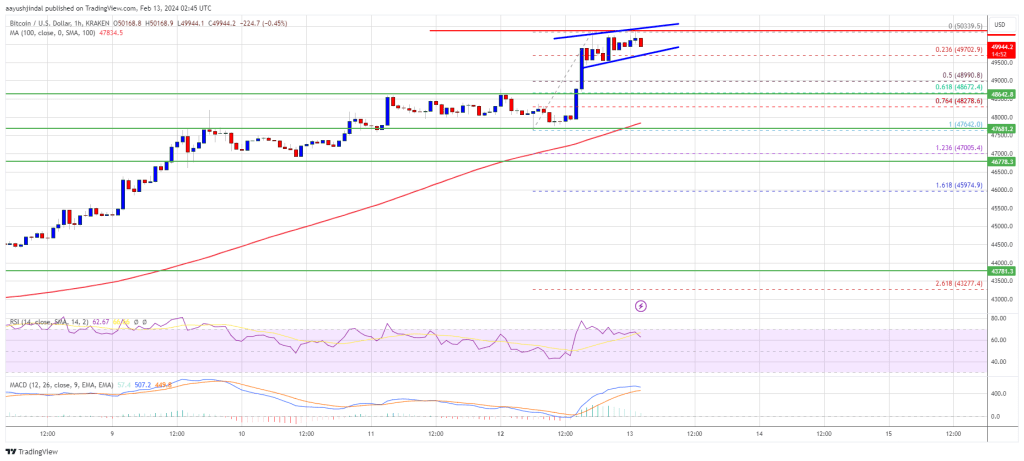

Bitcoin price extended its rally above the $48,800 resistance. BTC tested $50,000 and is currently showing signs of a downside correction.

- Bitcoin price climbed higher above the $48,500 and $48,800 resistance levels.

- The price is trading above $48,800 and the 100 hourly Simple moving average.

- There is a short-term rising channel forming with support at $49,750 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start a downside correction below the $49,750 and $49,500 levels.

Bitcoin Price Jumps 5%

Bitcoin price remained in a positive zone above the $48,000 resistance zone. BTC extended its rally and climbed above the $48,800 resistance zone. Finally, the price jumped above the $50,000 level.

A new multi-week high was formed near $50,339 and the price is now consolidating gains. There was a minor decline below the $50,000 level. The price is still above the 23.6% Fib retracement level of the recent rally from the $47,642 swing low to the $50,339 high.

Bitcoin price is now trading above $48,800 and the 100 hourly Simple moving average. There is also a short-term rising channel forming with support at $49,750 on the hourly chart of the BTC/USD pair.

Source: BTCUSD on TradingView.com

Immediate resistance is near the $50,250 level. The next key resistance could be $50,400, above which the price could start another decent increase. The next stop for the bulls may perhaps be $51,200. A clear move above the $51,200 resistance could send the price toward the $52,000 resistance. The next resistance could be near the $53,000 level.

Downside Correction In BTC?

If Bitcoin fails to rise above the $50,250 resistance zone, it could start a downside correction. Immediate support on the downside is near the $49,750 level or the channel trend line.

The first major support is $49,000 and the 50% Fib retracement level of the recent rally from the $47,642 swing low to the $50,339 high. If there is a close below $49,000, the price could gain bearish momentum. In the stated case, the price could dive toward the $47,650 support.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $49,750, followed by $49,000.

Major Resistance Levels – $50,250, $50,400, and $51,200.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]

Source link