[ad_1]

Charles Edwards, the founder of Capriole Investments, has recently provided an analysis in Capriole’s Update #13, predicting a significant upswing in the Bitcoin price to $58,000. His forecast is rooted in a detailed examination of market trends, ETF developments, technical patterns, and fundamental indicators.

In-Depth Market Analysis Of The Bitcoin Market

The analysis begins with a detailed look at the market’s recent behavior, focusing on the aftermath of Bitcoin ETF launches. Edwards points out, “Two months of chop and ETF readings under the microscope appears to be resolving to the upside as of writing.”

He highlights the significant shift in momentum following the initial “sell the news” reaction to the ETF launches, noting a considerable decrease in outflows from the Grayscale Bitcoin ETF. This change, according to Edwards, aligns with his previous predictions.

Furthermore, Edwards highlights the massive success of Blackrock and Fidelity’s Bitcoin ETFs (IBIT and FBTC), which have collectively absorbed over $6 billion in assets in less than a month. This achievement not only underscores the ETFs’ historic launch success but also signals a broader acceptance of Bitcoin within the traditional finance sector.

“Bitcoin [is] the most successful ETF launch in history by a very wide margin,” Edwards notes, referencing data from Eric Balchunas to emphasize the unprecedented scale of Bitcoin’s entry into the ETF market.

Here’s a look at the Top 25 ETFs by assets after 1 month on the market (out of 5,535 total launches in 30yrs). $IBIT and $FBTC in league of own w/ over $3b each and they still have two days to go. $ARKB and $BITB also made list. pic.twitter.com/Yyi1nxukUk

— Eric Balchunas (@EricBalchunas) February 8, 2024

A major milestone in Bitcoin’s institutional adoption is Fidelity’s decision to include Bitcoin in its “All-in-One Conservative ETF.” Edwards considers this move a significant endorsement of Bitcoin’s value as an investment asset, stating, “Bitcoin is finally being acknowledged in traditional investment vehicles.”

He predicts that this could set a precedent, with most major ETFs likely to allocate between 1-5% to Bitcoin in the next 12-24 months, emphasizing the critical importance of this development for Bitcoin’s mainstream acceptance.

Technical Outlook And BTC Price Prediction

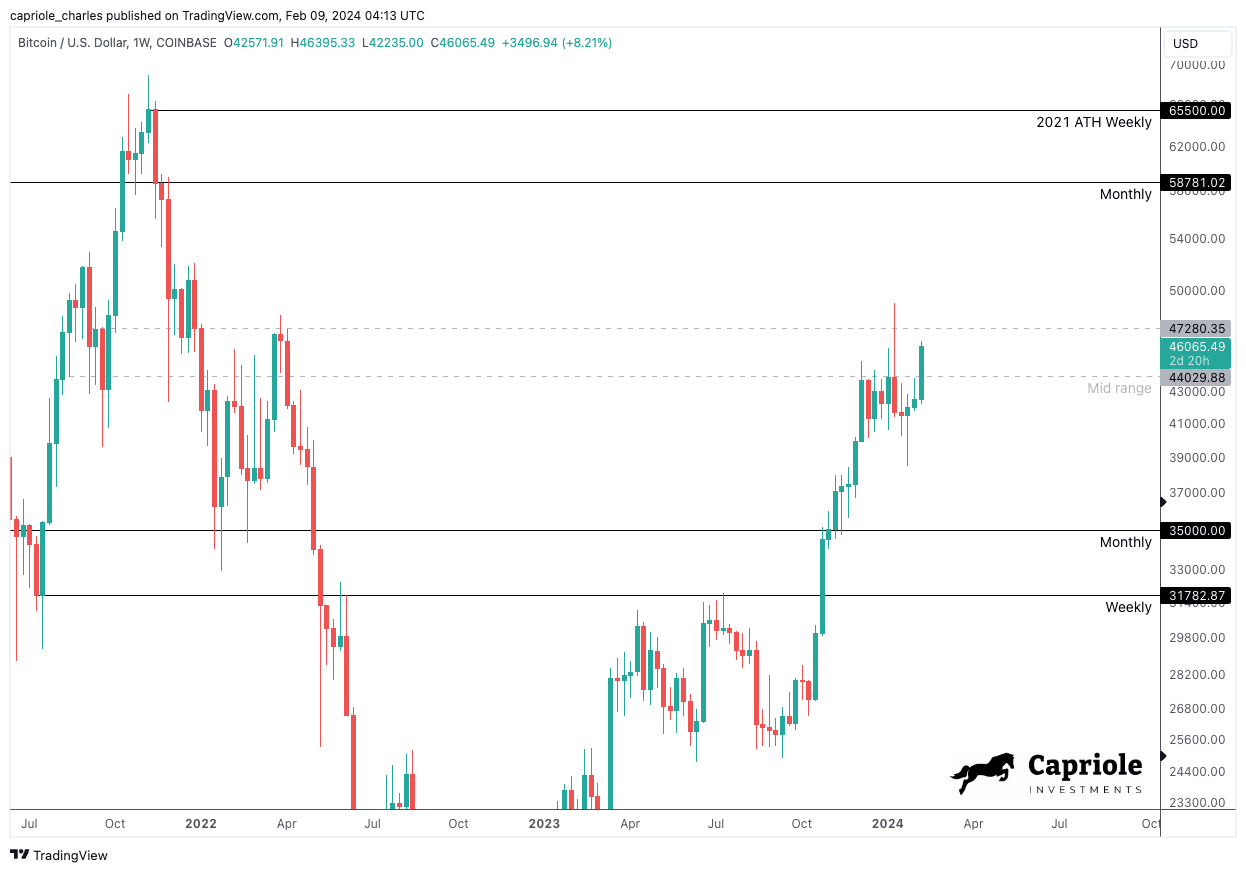

Turning to the technical analysis, Edwards points out the bullish trend that has taken shape, with Bitcoin breaking past the $44,000 resistance level. This breakout, according to Edwards, is a strong indicator of the market’s bullish sentiment and a precursor to further gains.

He notes, “The Weekly closing above $47K mid-range bound on Sunday would give a great technical confirmation of a new bullish trend,” highlighting the significance of this level as a determinant of the market’s direction.

Furthermore, Edwards elaborates on the low timeframe technicals, indicating a measured move towards the monthly resistance, which presents an attractive risk-to-reward (R:R) setup for investors. This technical breakout, combined with the strategic management of risk, underscores the potential for significant price appreciation in the near term.

A clean breakout on the daily timeframe of the $44K resistance is suggestive of a measured move to Monthly resistance. This is a good R:R setup. ‘Risk’ can be easily managed (a close back into the range at $44K would be a logic stop) with “Reward” 3-4X higher at $58-65K.

Fundamentals Turn Bullish

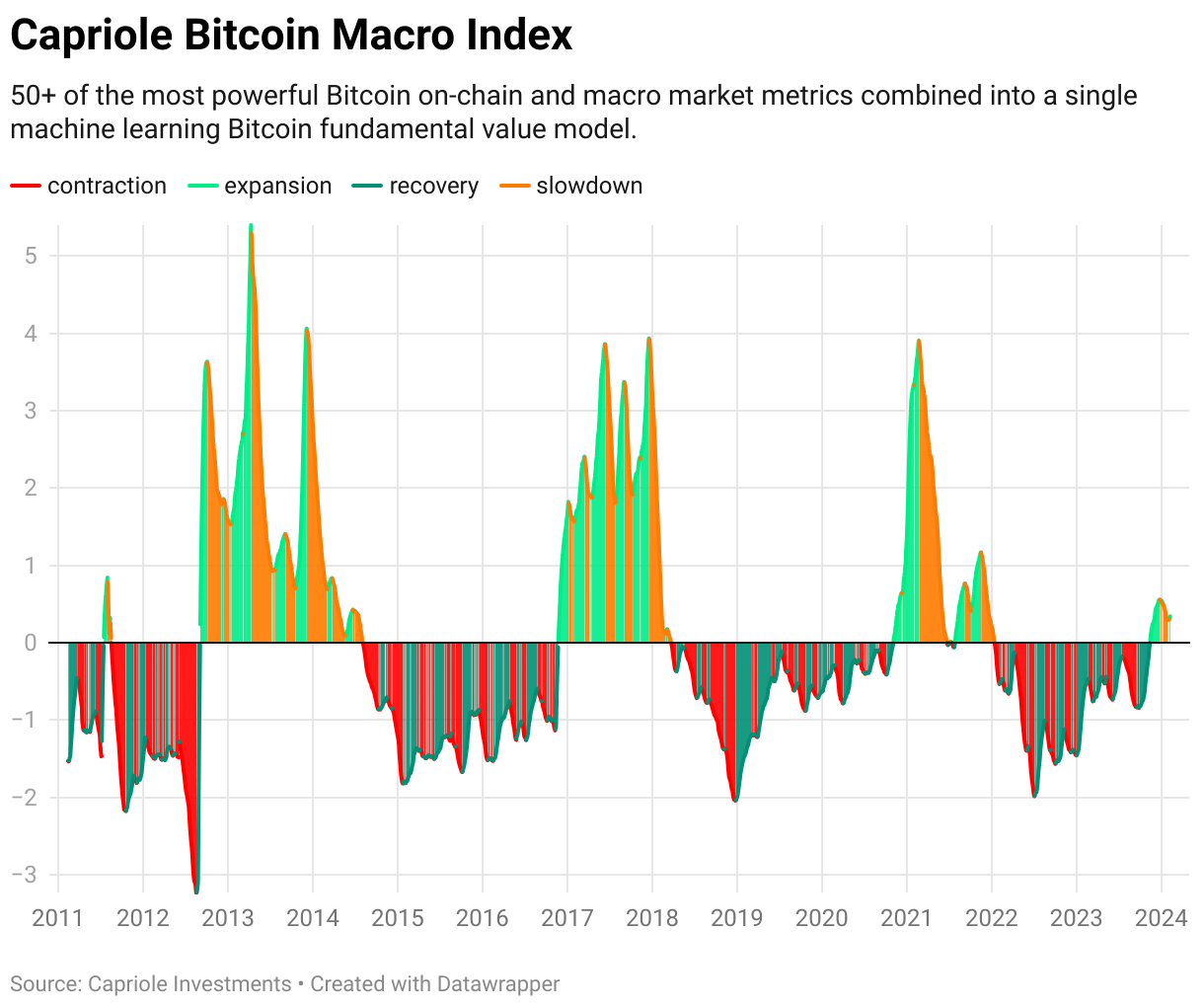

The foundation of Edwards’ bullish outlook is also built on a robust analysis of fundamentals and on-chain data. The Capriole’s Bitcoin Macro Index, which aggregates over 50 Bitcoin-related metrics into a single model, plays a crucial role in this analysis.

“The fundamental uptrend resumed on Wednesday which is also supportive of continuation of the technical move. We want to see on-chain fundamental growth continue with price to support confirmation of this mid-range breakout. Monday’s reading will be particularly important,” Edwards states.

Edwards’ analysis concludes on a bullish note, with a clear technical breakout and a transition of on-chain fundamentals into growth territory. “ETF FUD cleared. A Technical breakout on the daily timeframe and on-chain fundamentals transitioning into growth,” he summarizes, pointing towards a strong start to February and setting an optimistic tone for Bitcoin’s short-term future.

At press time, BTC traded at $46,790.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]

Source link